As anticipated, Apple Inc. has once again demonstrated its ‘survive’ abilities when it comes to sustaining the market, posting earnings that in fact exceeded Wall Street’s estimates even when there was a slight fall in iPhone sales. Apple is often under scrutiny in the competitive tech industry, especially when it comes to the iPhone, which has historically been the company’s biggest revenue generator. However, Apple was able to deliver an impressive performance in its most recent quarterly earnings report, which was above and beyond what analysts and investors were expecting, which gave them relief. In this blog, I would analyze Apple’s earnings report, identify the causes of the company beating the earnings, and discuss the repercussions of the growth (or decline) of iPhone sales in Apple’s future.

Apple Inc. Revenue Analysis 2023 Results: Most Important Figures

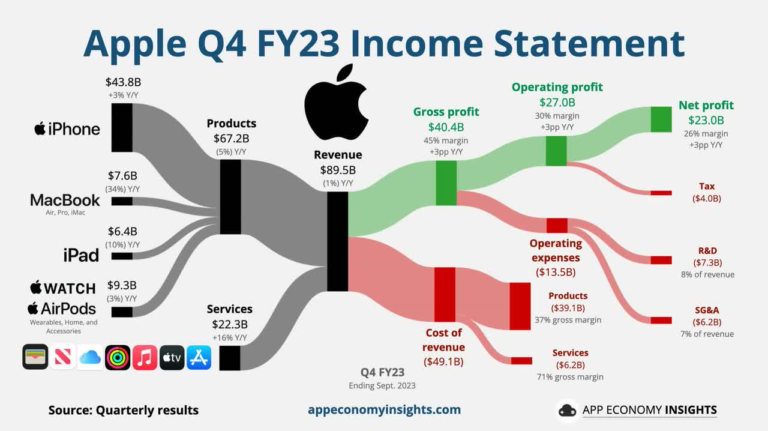

Now, prior to diving deep into the analysis there, let’s first review some of the important statistics from Apple earnings report which undoubtedly shocked Wall street. The company reported some extraordinary earnings for the quarter despite missing in iPhone sales. Here are the numbers Apple provided:

- Sales of iPhones: Apple sold $65 billion worth of iPhones, missing out, once again, on the expected mark of $67 billion.

- Sales of Other Product Types: Apple Watches, AirPods, other services and even Mac computers helped sell a lot more than expected, compensating for the not-so great performance of the iPhones.

- Despite the lower-than-expected revenue and earnings from iPhone sales, investors were happy about the remaining offset and the stock appreicated after the earnings call.

How Apple Managed The Missed Target Of The IPhone Sales

Apple’s most important and well-known product is still the iPhone and it represents a, reasonably high, percentage of Apples revenue. So much so, that many Wall Street analysts and investors use Apple stocks as an indicator of the company’s health and growth potential. If the iPhone sales numbers are low it causes a commotion in the market regarding future growth of the company.

Once again, Apple’s earnings are better than expected because of their services, and not even the iPhone sales can take that away from them. So, how exactly was Apple able to achieve such stellar results despite weaker iPhone sales?

Growth in Apple Services Revenue

Apple’s success this quarter was driven by its services division, which indeed changed the game. Over the past few years, Apple has put in a lot of effort to earn money from more than just hardware sales, which is why its services segment has become critical to its success. The services category includes iCloud, Apple Music, Apple TV Plus, and the App Store, and a whole collection of subscription-based offerings.

According to the latest earnings report, Apple managed to grow its services revenue by astonishing 12 percent year over year, hitting a whopping twenty billion dollars. The growth came from paid subscriptions that surpassed one billion for the first time in Apple’s history. Services have shown to be extremely reliable as a business and provide recurring revenue, which always helps cushion the blow when hardware sales, such as iPhones, do not meet expectations.

Excelling In The Quarter with Wearables and Mac Products

Yet another positive aspect for Apple came from its wearables segment that includes the Apple Watch, AirPods, and Beats headphones. The wearables division’s revenue increased by 9% this quarter, and Apple’s continuous development in this area has ensured strong momentum. Increased consumer interest regarding fitness and health tracking, along with easy integration with other devices, has positioned the company as a leader in this segment.

Along with wearing devices, Apple’s Mac business has also reported strong revenue performance with sales reaching $8 billion, which is a 7% growth over the previous quarter. Enhanced sales due to new model releases of MacBooks and the continued use of Apple’s proprietary M1 and M2 chips has enabled Apple to maintain its edge in the personal computing market.

Targeting Important Global Areas for Increased Market Share

Apple still performed well in certain international markets despite missing the sales expectations for the iPhone. The company continues to grow Apple market share in developing countries like India, while also strategically expanding its services business internationally. This further protects the company from the lower-than-anticipated sales of iPhones in Europe and North America.

The upper middle-class consumers in China are gradually shifting towards iPhones, and Apple has increasingly strengthened its position among them. This brand diversification over various geographies allows Apple to be less dependent on iPhone sales in certain countries, creating a stable market for the company to increase sales.

Focused Cost Restriction and Resilience in the Supply Chain

Along with other factors, Apple’s effective handling of supply chain issues contributed to the strong earnings report. Unlike other competitors in the tech industry, Apple has efficiently dealt with the disruptions from the global semiconductor shortage and other supply chain complications. Apple has been able to meet product delivery expectations because of well-timed product launches, streamlined manufacturing processes, and strong aftermarket supplier relationships.

Apple improved cost management by optimizing inventory control and enhancing production processes, all of which helped maintain the company’s margins, even when iPhone sales were below expectations. These measures have helped the company to consistently exceed profit expectations, which is remarkable.

Apple’s Commanding Presence in Tech

Although iPhone sales have declined, Apple is still a powerful leader in technology. The ability to invent new products and, at the same time, change the scope of the business has been important for growth. Now let’s examine the more broad strategic changes at Apple that seem to be supporting the company’s success.

The Move Towards Subscription and Service Models

Apple has shifted focus to service provision as one of its most important changes over the last few years. While the iPhone is here to stay and will be a big source of revenue for Apple, over time the company has depended more on services for steady, repeatable revenue stream. This has been spearheaded by a subscription model with several new services like Apple Music, Apple TV+, iCloud, and Apple Arcade.

Apple’s services model boosts revenue without depending entirely on hardware sales. As consumers continue to migrate to digital subscriptions and cloud services, Apple stands to benefit. The company’s seamless integration of hardware, software, and services has enhanced the stickiness of its ecosystem, making users more prone to brand loyalty over time with Apple products.

Innovation in Hardware and Software

New hardware and software offerings is a key strategy of Apple’s, and the company continues to innovate with advancements. Apple has differentiated itself from the rest of the competition in the personal computing space with the shift to its custom-designed M1 and M2 chips. These new MacBooks, which are powered by the chips, have been received favorably by both professionals and average users because of their impressive performance and energy efficiency.

In the smartphone sector, Apple is likely to keep launching new versions of the iPhone that come with new features and innovations to ensure the product remains competitive. The integration of hardware and software to deliver a product is what differentiates Apple, and that is how the company ca maintain user experience, which is vital to customer satisfaction and retention.

Initiatives for Social Responsibility and Environmental Protection

AWhother major focus for Apple Inc. is the environmental and social responsibility of the company. The corporation has been actively working to decrease its carbon emissions and plans to become fully carbon neutral by 2030. Alongside this, Apple has also been improving labor relations along its supply chain and ensuring compliance with high moral standards.

These initiatives serve not only environmental conservation and social good but also aid increases the brand image of Apple Inc. Citizens are starting to prefer spending money based on the environmental and social efforts put forth by a particular company, which means the efforts put by Apple Inc is helping it have a good image in the market.

Final thoughts: What Lies Ahead for Apple?

Apple appears to be struggling as the sales of iPhones do not hit the targets set by Wall Street, but the filing of the services Apple incorporates within the best service provider reveals a different truth. Apple continues to perform well due to the expansion of the services segment, the strength in wearables and Mac computers, the penetration into foreign markets, and the company’s proficient organization of the supply chain. And apple is still set to do well because of its innovative and Apple’s focus towards social and environmental sustainablity.

Moving forward, Apple is likely to face hurdles within a competitive market, and will need to shift their focus from the iPhone towards innovation in Apple services. However, Apple’s expanding ecosystem and various sources of income will help the company in the long run. Investors and consumers can expect Apple to remain a leader within the decade.